France has implemented a ban on PFAS in cosmetics and textiles as of January 1, 2026. Denmark is set to follow in July with restrictions targeting consumer clothing and footwear. At the EU level, a universal PFAS restriction—covering more than 10,000 chemical compounds, including those used in nonstick cookware coatings—is currently on track for a European Commission decision in 2027.

For companies that are doing cookware sourcing for the European market, the regulatory landscape is shifting faster than many buyers expect—not in the distant future, but right now.

Neste artigo, a Purecook, uma leading stainless steel cookware manufacturer, breaks down what’s actually happening with the EU PFAS ban, which cookware products face the most risk, and why stainless steel is quietly becoming the default safe bet for wholesale buyers planning their product lines for 2027 and beyond.

What Are PFAS, and Why Should Cookware Buyers Care?

PFAS — per- and polyfluoroalkyl substances — are a family of over 10,000 synthetic chemicals. The industry calls them “forever chemicals” because they don’t break down in the environment. Not in decades. Not in centuries.

They’re everywhere: firefighting foams, food packaging, waterproof textiles. And yes, cookware. Specifically, PTFE-based nonstick coatings — the technology behind Teflon and its many successors — are classified as PFAS.

Here’s what matters for cookware sourcing: PTFE (polytetrafluoroethylene) is itself a PFAS compound. So when regulators ban PFAS as a class, they’re not just targeting the old, already-phased-out PFOA. They’re targeting the coatings still used on the majority of nonstick pans sold worldwide.

A 2025 Consumer Reports survey found that 65% of U.S. adults are at least somewhat concerned about PFAS in their cookware. That consumer anxiety is now translating into regulatory action — and it’s moving faster in Europe than anywhere else.

The Regulatory Timeline: Where Things Stand Right Now

The situation is complex for cookware sourcing at this moment, so here’s a clear breakdown of the key milestones:

Already in effect: France’s Law 2025-188, passed February 27, 2025, banned PFAS in cosmetics, consumer textiles, footwear, ski wax, and waterproofing agents as of January 1, 2026. Cookware was originally included in the draft but removed after intense industry lobbying — most notably from Groupe SEB, which manufactures Tefal. Environmental groups have called this exemption a major shortcoming. The key takeaway for buyers: cookware was not deemed “safe”—it was temporarily carved out.

Coming in 2026: Dinamarca will ban the sale and import of consumer clothing, footwear, and waterproofing products containing PFAS starting in July 2026. The EU’s Packaging and Packaging Waste Regulation (PPWR), which entered into force in February 2025, already sets PFAS limits for food-contact packaging.

Meanwhile, ECHA’s scientific committees (RAC and SEAC) are finalizing their evaluation of the universal PFAS restriction proposal. RAC’s final opinion and SEAC’s draft opinion are expected in the first half of 2026, with a public consultation to follow.

Expected 2027 and beyond: ECHA aims to deliver its final opinions to the European Commission by the end of 2026. The Commission is expected to issue a decision in 2027. If a restriction is adopted, most sectors face an 18-month transition period. Some industries may receive time-limited derogations of up to 13.5 years — but consumer nonstick cookware is unlikely to qualify.

Why? Because the updated restriction proposal, published by ECHA in August 2025, explicitly states that substitutes are available for consumer nonstick cookware.

Under EU regulatory logic:

No viable substitutes = potential derogation.

Viable substitutes available = no exemption.

The direction is clear. The only question is exactly when, and whether continuing to make cookware sourcing on PFAS-based nonstick cookware still makes commercial sense for the EU market.

Which Cookware Products Are at Risk?

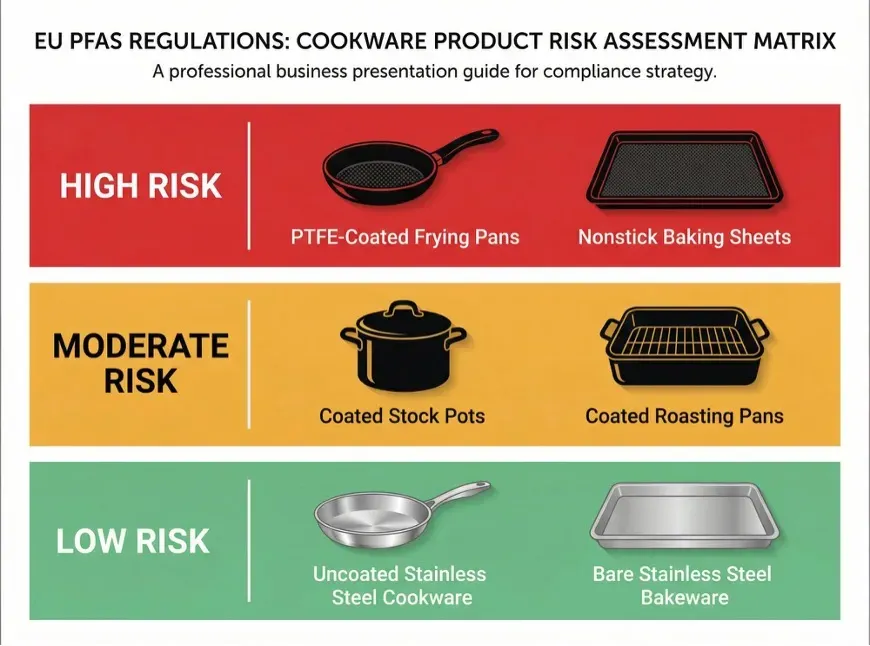

Purecook, here, is to provide a practical risk assessment for cookware sourcing buyers who target the EU market:

High risk — directly affected by PFAS restrictions: PTFE-coated nonstick frying pans, saucepans, and cookware sets. This is the core target. PTFE is a fluoropolymer and falls squarely within the PFAS definition used in the EU proposal. “PFOA-free” labels don’t help — the coating itself is the issue.

Moderate risk — may need reformulation: Cookware with certain PVD coatings or specialty surface treatments that use fluorinated compounds in the process. Not all PVD coatings involve PFAS, but buyers should verify. We’ve written in detail about how surface treatments work and why they matter — it’s worth revisiting that piece with PFAS compliance in mind.

Low risk — inherently PFAS-free: Bare stainless steel cookware. Cast iron. Carbon steel. Enameled cookware. Ceramic-coated cookware (though ceramic coatings carry their own durability concerns). These materials have no PFAS in their composition and require no reformulation.

Side note: this is one of those regulatory shifts that sounds abstract until it hits your supply chain. If 40% of your cookware line is PTFE-coated nonstick, you’re looking at a product-line overhaul within 2-3 years. Better to start planning now than to scramble when the restriction date is announced.

Why Stainless Steel Is the Safest Long-Term Bet

Stainless steel cookware has no PFAS. Period. No coatings to reformulate. No chemicals to phase out. No PFAS-related compliance risk under any current or proposed regulation worldwide — a critical advantage for long-term cookware sourcing strategies targeting the EU and North American markets.

That’s the short answer. The longer answer involves market positioning and brand strategy within an increasingly risk-sensitive cookware sourcing environment.

The “non-toxic cookware” segment is booming. Brands like Caraway, GreenPan, and Made In have built entire product lines around the PFAS-free promise. But ceramic nonstick coatings — while PFAS-free — have well-documented durability issues. They lose their nonstick properties within one to two years of regular use. That’s fine for a $35 consumer pan. It’s a problem if you’re building a premium brand.

Stainless steel, by contrast, offers a decades-long service life. A well-made tri-ply stainless steel pan — outer 430 SS for induction compatibility, aluminum core for heat distribution, inner 304 SS for food safety — gives your customers a product that performs for decades without relying on any surface coating that can degrade over time.

Does stainless steel require a bit of technique to prevent sticking? Yes. We’ve addressed this head-on in our guide on whether stainless steel cookware is nonstick. The honest answer: it’s not zero-stick like PTFE, but with proper preheating and a small amount of oil, food releases cleanly and consistently. Most professional chefs prefer it precisely because of the browning and fond development you can’t get with nonstick.

For wholesale buyers, stainless steel checks every box that matters right now: zero PFAS compliance risk, premium-friendly positioning, long product lifespan, and demand growth driven by increasing consumer health awareness.

The U.S. Is Moving Too — Don’t Ignore It

Europe gets the headlines, but U.S. states are acting independently and sometimes more aggressively – a trend that is increasingly reshaping global cookware sourcing decisions.

Minnesota banned PFAS in cookware (among 11 product categories) as of January 1, 2025 — a full year before France’s law took effect. Maine passed a blanket ban on all intentionally added PFAS in all products, with a 2032 deadline. California considered a similar cookware ban in 2024; the governor vetoed it, but the legislative pressure hasn’t stopped.

At the federal level, the EPA’s TSCA reporting rule requires manufacturers to report PFAS usage starting April 2026.

If you sell cookware into both the EU and the U.S., you’re facing convergent regulatory pressure from both sides of the Atlantic. From a cookware sourcing perspective, a single PFAS-free product line that works everywhere is simpler and cheaper than maintaining separate SKUs for different regulatory regimes.

What Wholesale Buyers Should Do Right Now

You don’t need to panic-pivot your entire catalog overnight. But you do need a plan. Here’s what we recommend based on conversations with our buyers and what we’re seeing in order patterns across current cookware sourcing decisions:

Audit your current product mix. Identify every SKU that uses PTFE or any fluorinated coating. Calculate what percentage of your line is affected. If it’s significant, you need a transition roadmap for future cookware sourcing.

Understand your target markets. If you’re selling into France, the regulatory writing is on the wall — even though cookware got a temporary exemption, environmental groups are pushing hard for inclusion in the EU-wide restriction. If your buyers are in Minnesota, you may already be non-compliant without knowing it.

Start sampling stainless steel alternatives. O material grade matters. For food-contact cookware sold in regulated markets, 304 (18/8) stainless steel is the baseline — it meets FDA 21 CFR, EU 1935/2004, and China’s GB 9684-2011. We don’t recommend 201 for food-contact applications. Full stop. The chromium and nickel content in 201 doesn’t meet the migration limits required by EU and U.S. standards. If you need a refresher on what goes into stainless steel cookware and why it matters, that’s a good starting point.

Talk to your factory about lead times. Switching from nonstick to stainless steel isn’t just a materials swap — it’s a different production process. Deep-drawing stainless steel on a hydraulic press, polishing to a mirror or satin finish, assembling tri-ply construction — these require specific equipment and expertise. Our standard lead time for new stainless steel cookware orders is 30-45 days, or 45-60 days for custom OEM projects with new tooling.

Position your brand ahead of the curve. Don’t wait for the regulation to hit and then market “PFAS-free” as a scrambled reaction. Start now. From a long-term cookware sourcing standpoint, brands that lead on safety messaging — backed by actual material certifications, not just marketing claims — will capture the premium segment as PFAS bans roll out across markets.

How Purecook Helps With Your Cookware Sourcing and Transition

We’ve been manufacturing stainless steel cookware for over 20 years. No PTFE lines. No nonstick coatings to phase out. Our entire production capability — from raw 304 and 316 sheet to finished, polished, packaged cookware — is inherently PFAS-free.

Every incoming steel batch passes through our spectrometer to verify chromium and nickel content before entering production. We hold ISO 9001, BSCI, LFGB, and FDA compliance certifications. Our products ship to over 50 countries, including markets with the strictest food-contact regulations in the world.

If you’re a brand owner looking to expand your stainless steel line — or a nonstick-focused brand looking to add PFAS-free options — we can help with OEM/ODM customization, from material selection to surface finish to custom branding and packaging.

Browse our stainless steel cookware catalog ou contact us directly to discuss your sourcing needs. We’ll send samples within 7-10 days of confirming specs.

The PFAS ban is coming. Your product line should be ready before it arrives.